Stock Playlists - Interview with Jannick Malling, Public.com

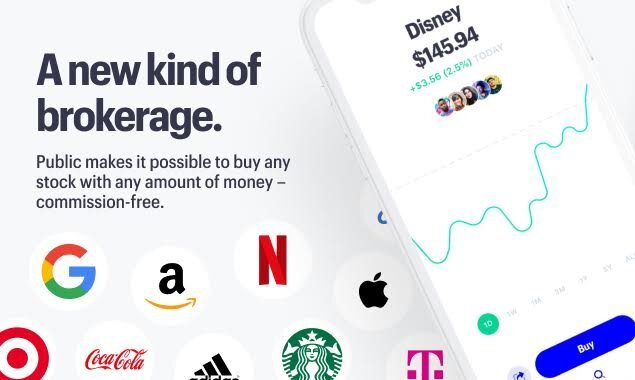

Public is a stock trading app that allows you to buy any amount of stock for any amount of money, commission free. To find out more, I interviewed Jannick Malling, co-founder and co-CEO of Public.com.

Courtesy of Public.com

Thanks for responding to my questions. First off, I love the idea! It is all about getting people, particularly women, involved in personal finance by getting them interested in the companies behind the investments. I like to think of it from a backwards perspective - what are you interested in? What companies do you engage with? Use that interest to learn about the company and then your interest in investing will follow. So I like this app as it is aimed at breaking down those barriers for beginners to get involved in their own personal finance.

Jannick: That’s exactly right. That’s how we think about it, too.

Most people who are getting started in investing don’t want to tear through a bunch of annual reports, earnings calls, etc. They really just want to start with the companies they know and love. So, when we were designing Public, we thought more about discovering the stock market—similar to how you discover music. The result is what we call “Themes,” which is our version of a Spotify playlist, where you can easiler discover companies that share certain values. A few examples of Themes include The Future is Female (top public companies run by women), Self-Driving Cars (companies at the forefront of the autonomous vehicle movement), Cure Cancer (companies investing in finding a cure for cancer), and many more.

What is your background and what sparked the idea for the app?

Jannick: Most people are surprised when I tell them this, but the U.S. stock market has grown almost 10% per year on average over the last 100 years. Since being created around 400 years ago, it’s been the biggest driver of prosperity in the history of mankind. You probably can’t find a millionaire in this country that isn’t or hasn’t invested in the stock market.

But soon after moving to the U.S. I realized most people in our generation weren’t invested in the stock market. They found it to be daunting or intimidating, and thought they needed to save up tens of thousands of dollars to get started. As a result, almost 85% of the stock market is owned by the 10% richest.

When it became apparent that the “public markets” are really the markets for the few, we decided to build a new—and better—way to invest that is easier to use and allows you to get started investing in the companies you love with as little as $5.

Where geographically is it currently available?

Jannick: Public is currently available for people permanently residing in the United States. We’d love to expand the service to Canadians—as well as all people globally, quite frankly—but, since we’re a regulated stock brokerage, it’s not as simple as just releasing the app on the Candian App Store. There are certain steps we’d need to take before we could start expanding internationally, and I’m hopeful we will start looking at those in the near future.

How does it work logistically? I find that is often a barrier for women in terms of how actually do I get set up? Do you put in a sum of money into an account (can you do a direct transfer from your bank?) and then use the funds from there? Does the unused money earn interest? Is there a minimum investment required?

Jannick: The traditional way of investing is indeed full of barriers that can make the whole experience quite daunting. That is why we created Public!

You can sign up in less than two minutes through a delightful sign-up flow. As part of that process, you simply connect your bank account and then you’re ready to go. You don’t have to make a deposit until you’re ready to invest, but since uninvested cash in your brokerage account grows at a baseline of 2.5% (up to $10,000), many people decide to just make a deposit immediately.

Making an actual investment is my favorite part. With our “Slices” concept, you can invest any amount of money in any stock. On traditional platforms, you’re limited to buying a specific number of shares at the price per share the stock is trading at. Amazon, for instance, is currently at $1,775. That is a lot of money to a lot of people, so we slice up shares and let our users buy them with as little as $5 at a time.

What types of investments are available on the app?

Jannick: We support around 9,000 U.S. stocks, index funds, and ETFs. Most are companies that are publicly traded in the U.S. (New York Stock Exchange or NASDAQ) but we also offer investing in an increasing amount of international companies.

Additionally, your uninvested cash grows at a baseline of 2.5%. That’s our “cash management” product and it results in people not “rushing” into their first investment.

How does the app handle dividends?

Jannick: You get paid dividends as you would on other platforms. The difference is that since Public supports partial share investing you can invest any amount of money into any stock, regardless of the price per share of the stock. So if you get a $1 dividend from Amazon, you can invest that $1 instead of saving up another $1,774 before you can afford to buy another full share of Amazon (one share costs $1,775 at the time of writing.)

Is there a minimum amount one must start with for investing?

Jannick: No, you can open your account with whatever amount of money you’re comfortable with. Even $1. Seriously.

Most traditional investing platforms say they have no minimum account balance requirement, which is technically true, but you still have to buy one full share of a company. So if you’re buying Apple, that’s $240. On Public, you can actually buy $1 of Apple.

How do the slices or fractional ownership work in terms of selling? Are there any additional hoops with respect to selling when you own a fractional share? I appreciate the logistics may be complicated and technical but are you able to give a brief description of how fractional or slices of shares are made possible for buying and selling? For example, is it a matter of five different people each buying ⅕ and that makes up the 1 whole share?

Jannick: All buy and sell orders are processed at the best available price in the market, instantly. On other apps you have to wait for the next day to sell your position because they’re waiting to bundle / group orders together, but that is scary for a lot of people. So we went the extra mile and created the first and only app to offer instant and real-time fractional share buying and selling, giving our customers full control.